Giving Appreciated Stock

Giving Appreciated Stock

Gifting stock is an easy process. Some benefits of your gift are:

- Completely avoid paying capital gains tax by giving stock directly to KSCE

- Receive a tax deduction up to 30% of adjusted gross income, and there is a five-year carryover

- You may be able to give substantially more with a gift of stock, for the same after-tax cost of giving cash

Example:

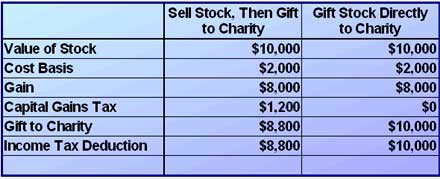

Charlie Johnson recently made a pledge towards his church’s capital campaign, and is considering utilizing stock he owns towards his commitment. Years ago, as a young engineer, he purchased shares of company stock for $2,000. He since left the firm but held the shares as an investment and they now have a market value of $10,000.

If he gives the stock to his church, he can claim a charitable deduction of the full market value of the gift ($10,000). The church can then sell the stock and apply the full proceeds ($10,000) towards their campaign. And, since a gift to the charity is not a sale, he will not owe any capital gains tax on the transaction.

If Charlie were to sell the stock himself, he will incur $8,000 in capital gain ($10,000 market value minus $2,000 cost basis). After he pays taxes of $1,200 (the 15 percent capital gains tax rate on the $8,000 gain), his gift to charity and charitable deduction will be only $8,800.

Click image to enlarge

For assistance in gifting appreciated stock (click here)

Wills & Trusts Teleconference | Overview of Estate Planning | How to Get Started

Information on this site is NOT intended for legal advice. See Disclaimer